Start Your Own Business

“In the midst of chaos, there is also opportunity”.

- Sun Tzu

Have you been thinking about becoming an entrepreneur?

One way to take back your freedom is to start your own business. Whether you’re an employee losing your job because of mandates, a small business owner that has struggled through lockdowns, or someone who is looking to diversify their income, Citizen Corps is here to support you.

Does becoming an entrepreneur excite you?

Does it scare you? Starting your own business can feel overwhelming. But you don’t need to do it alone. There are many organizations available to support you from developing your business plan to mentoring. And many of these resources are free or low cost. Here are some ideas to get you started

10 Steps to Start Your Business

#1

Conduct Market Research

#2

Apply for Licenses and Permits

#3

Choose Your Business Name

#4

Pick Your Business Location

#5

Choose Your Business Structure

#6

Register Your Business

#7

Get Federal and State Tax IDs

#8

Fund Your Business

#9

Write Your Business Plan

#10

Open a Business Bank Account

Get free support from these organizations, nationally and locally, to start your own business

Your local County Library often has access to free classes and information for small business help.

The Startup Roadmap:

YWCA USA:

America's SBDC:

Common Types of Business Structures

| ENTITY TYPE | LIABILITY | TAXATION | FORMATION | MAINTENANCE |

|---|---|---|---|---|

| SOLE PROPRIETORSHIP | Owner personally liable for business debts. Same advantages as a regular limited liability company. | Owner reports profit or loss on his or her personal tax return. | Simple and inexpensive to create and operate. | No formal corporate maintenance is required. |

| GENERAL PARTNERSHIP | Owner (partners) personally liable for business debts. | Owner (partners) reports profit or loss on his or her personal tax returns. | Simple and inexpensive to create and operate. | General partners can raise cash without involving outside investors in management of business. |

| LIMITED PARTNERSHIP | Limited partners have limited personal liability for business debts as long as they don't participate in management. | The limited partnership provides the limited partners a return on their investment (similar to a dividend),the nature and extent of which is usually defined in the partnership agreement. | Suitable mainly for companies that invest in real estate. More expensive to create than general partnership. | Limited partners have no management authority, and (unless they obligate themselves by a separate contract such as a guaranty) are not liable for the debts of the partnership. |

| LIMITED LIABILITY COMPANY | Combines a corporation's liability protection and pass-through tax structure of a partnership | IRS rules now allow LLCs to choose between being taxed as partnership or corporation. | More expensive to create than partnership or sole proprietorship | Sale of member interests may take place per company policy. Significantly easier to maintain than a corporation. |

| PROFESSIONAL LIMITED LIABILITY COMPANY | Members have no personal liability for malpractice of other members; however, they are liable for their own acts of malpractice. | A single member PLLC is treated as a disregarded tax entity, the same as a sole proprietor, giving it pass-through tax treatment. A multiple member PLLC taxed as a partnership. | State licensed professionals a way to enjoy LLC advantages. Members must all belong to the same profession. Not available in all states. | Members have great flexibility through written operating agreement to define rights & responsibilities, powers, nancial matters of PLLC, and rights / restrictions re: ownership interests. |

| C-CORPORATION | Owners have limited personal liability for business debts. | Owners can Split corporate profit among owners and corporation, paying lower overall tax rate. Separate taxable entity. Fringe benefits can be deducted as business expense. | May have an unlimited number of shareholders. More expensive to create than partnership or sole proprietorship. | Shares of stock may be sold to raise capital. Meetings are required to maintain corporate status. |

| PROFESSIONAL CORPORATION | Owners have no personal liability for malpractice of other owners. Owners have liability for own acts of malpractice. | PCs are granted the taxation benefits of a corporation. | More expensive to create than partnership or sole proprietorship. All owners must belong to the same profession. | Formality requirements (e.g. annual reports, minutes, meetings) are required to maintain corporate status. |

| NON-PROFIT CORPORATION | A nonprofit corporation is a corporation formed to carry out a charitable, educational, religious, literary, or scientific purpose. | Full tax advantages available only to groups organized for charitable, scientific, educational, literary or religious purposes. | A nonprofit corporation doesn't pay federal or state income taxes on profits it makes from activities in which it engages to carry out its objectives. | Formality requirements (e.g. annual reports, minutes, meetings) required. Property transferred to corporation stays with corporation; if corporation ends, property must go to another nonprofit. |

| S-CORPORATION | Owners have limited personal liability for business debts. | Owners report their share of profit or loss on their personal tax returns. Income must be allocated to owners according to their ownership interests. Owners can use corporate loss to offset income from other sources. Fringe benefits limited for owners who own more than 2% of shares. | More expensive to create than partnership or sole proprietorship. | More formality requirements than for a limited liability company which offers similar advantages. |

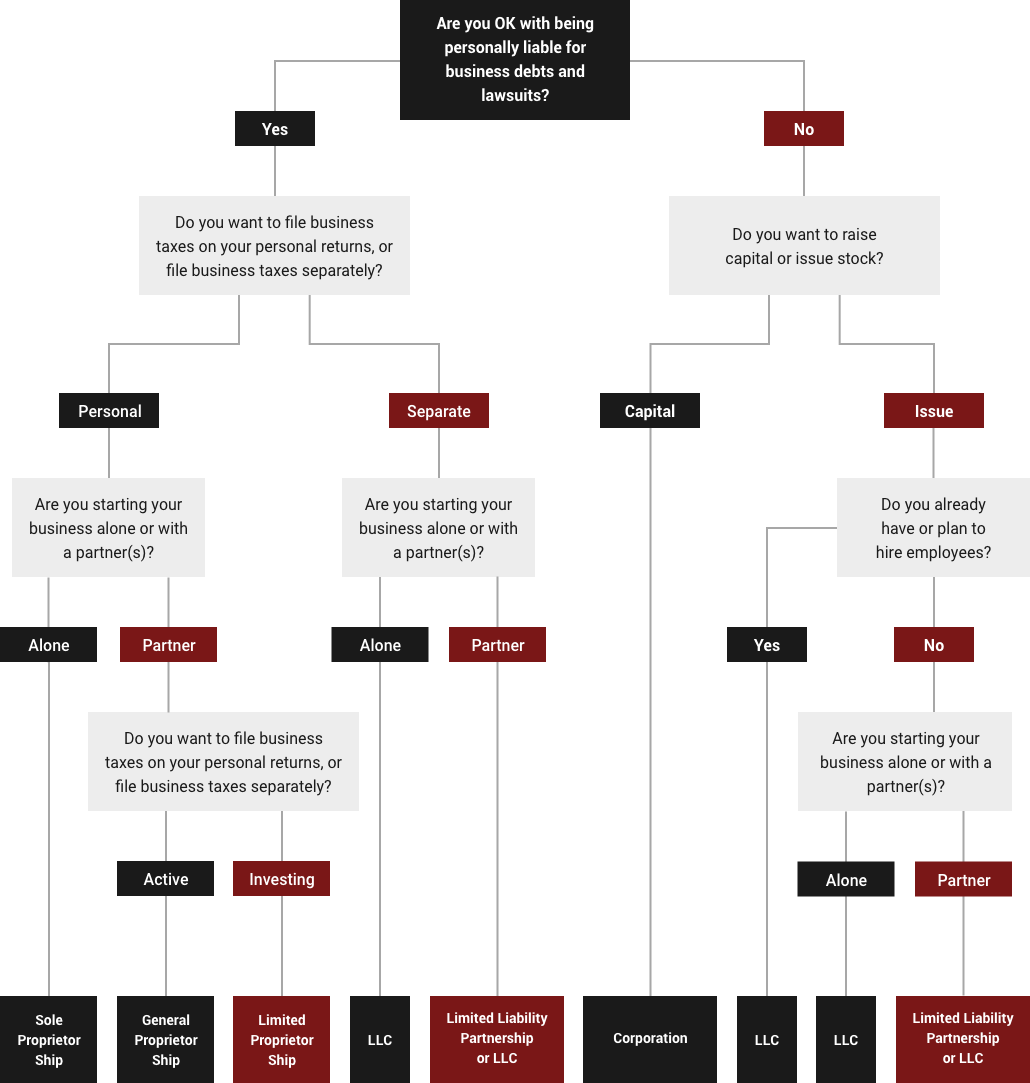

Choosing a personal liability risk for your business

Please note that the information, websites, and listings included here are provided as resources only. Some of these have been promoted by freedom fighters, businesses, and organizations and while sources have been researched, their inclusion here is not an endorsement by AFLDS.